In the fast-paced world of financial transactions, fraudsters are always looking for new ways to exploit vulnerabilities. Traditional fraud detection methods, like rule-based systems and conventional machine learning models, are struggling to keep up with these evolving threats. That’s where the innovative work of Saad M. Darwish, from the Department of Information Technology at Alexandria University’s Institute of Graduate Studies and Research, comes into play. His research, published in the journal ‘Cybersecurity’ (translated from Russian), explores a promising solution: combining lightweight blockchain technology with deep learning to bolster fraud detection in financial transactions.

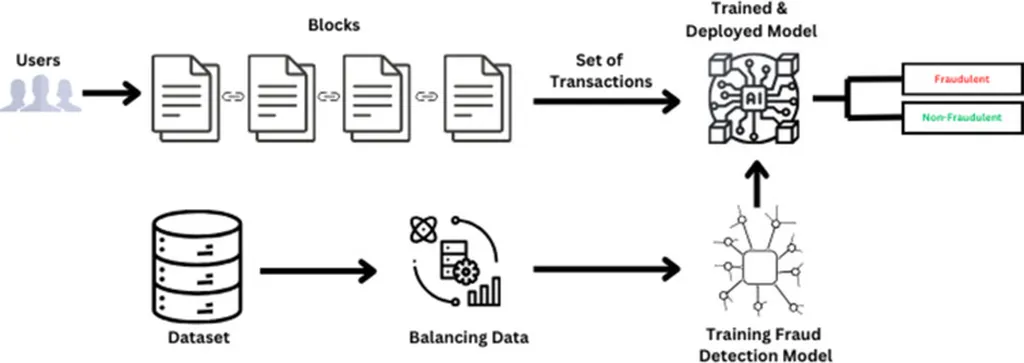

So, what does this mean for the maritime industry? Well, imagine a system that can detect fraudulent transactions in real-time, even on resource-constrained devices like mobile phones or IoT devices on ships. This is exactly what Darwish’s model aims to achieve. By integrating lightweight blockchain technology, the system ensures that transaction data is immutable, transparent, and tamper-proof. Meanwhile, deep learning provides dynamic and adaptive detection capabilities, using neural networks to identify anomalous patterns in complex datasets.

“Our model combines these components, ensuring data integrity through blockchain while enabling efficient pattern recognition via deep learning,” Darwish explains. This combination creates a system that’s not only secure but also scalable and energy-efficient, addressing some of the key challenges in fraud detection.

For the maritime sector, this technology could be a game-changer. Maritime transactions often involve complex, high-value deals that are prime targets for fraud. With this new approach, companies could significantly reduce the risk of fraudulent activities, enhancing the security of their financial transactions. Moreover, the system’s ability to operate in real-time and on resource-constrained devices makes it particularly suitable for the maritime environment, where connectivity can be a challenge.

The commercial impacts of this technology are substantial. By reducing false positives and enhancing detection rates, companies can save millions in potential losses due to fraud. Additionally, the system’s scalability means it can be easily integrated into existing financial systems, making it a cost-effective solution for companies of all sizes.

In conclusion, Darwish’s research offers a promising solution to the growing challenge of fraud detection in financial transactions. For the maritime industry, this technology could provide a much-needed boost in security and efficiency, helping to create a safer and more reliable financial ecosystem. As Darwish puts it, “This marks a significant step toward secure and efficient financial ecosystems.”