The maritime simulators market is on course for steady growth, projected to rise from $1.67 billion in 2024 to $1.77 billion in 2025, according to The Business Research Company’s latest report. This represents a compound annual growth rate (CAGR) of 5.8%, driven by a surge in demand for advanced training solutions and digital navigation systems. The industry is dominated by a mix of global tech giants and specialized maritime training developers, all racing to enhance simulation realism and operational safety.

Wärtsilä Corporation leads the pack, claiming a 6% market share in 2023. The company’s marine division is deeply invested in the market, offering a suite of advanced simulators, including full mission bridge and engine room systems. These tools are designed to boost maritime safety, efficiency, and crew competence through realistic, customizable training experiences. Wärtsilä’s commitment to innovation underscores a broader industry trend: the push for immersive, tech-driven training environments.

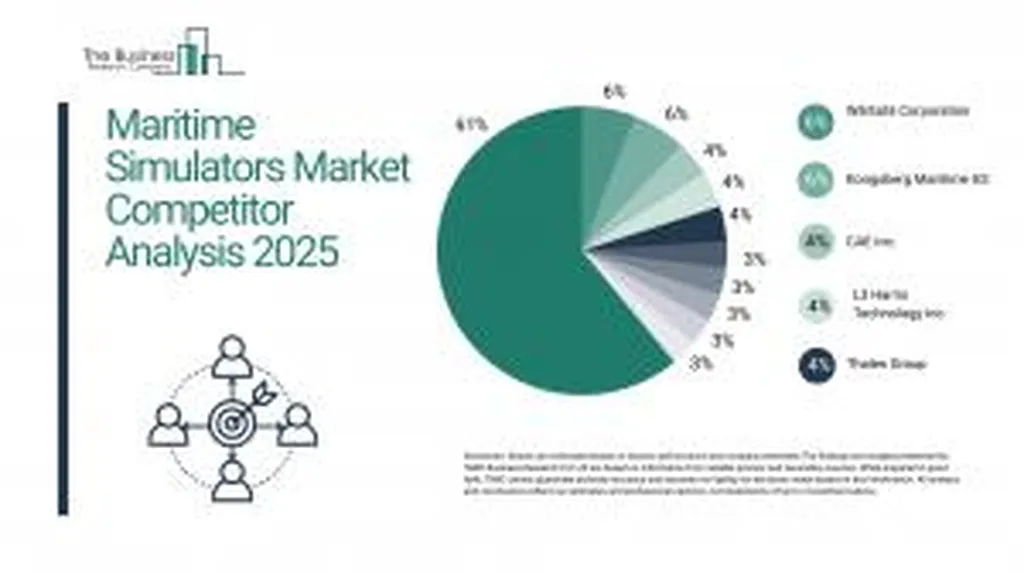

The market is concentrated, with the top 10 players accounting for 38% of total revenue in 2023. This concentration reflects the industry’s reliance on high-fidelity simulation technologies and the need for trusted, certified training systems. Alongside Wärtsilä, key players like Kongsberg Maritime AS, CAE Inc., L3Harris Technologies, and Thales Group dominate through comprehensive simulation platforms and strong global partnerships. These companies are not just selling products; they’re building ecosystems that integrate training, research, and operational planning.

Regional dynamics add another layer of complexity. In North America, companies like Buffalo Computer Graphics and Maritime Professional Training are leading the charge, while Asia Pacific sees strong performances from firms like Xiamen Hefeng Interactive Technology and Nanjing Ninglu Technology. Western Europe’s landscape is shaped by players like Leonardo S.p.A. and Rheinmetall AG, while Eastern Europe and South America feature a mix of global and regional leaders.

The competitive landscape is evolving rapidly. Enhanced training realism is a major trend, with innovations like FORCE Technology’s Extended Reality (XR) Full Mission Bridge Simulator setting new benchmarks. These advancements highlight a commitment to maritime innovation, environmental responsibility, and global connectivity.

Companies are adopting a range of strategies to stay ahead. High-fidelity simulation modules and immersive VR/AR training environments are becoming standard, enhancing crew competency and safety readiness. Strategic partnerships with maritime academies, navies, and commercial shipping companies are broadening market reach. Digital navigation systems and real-time vessel analytics are providing advanced, data-driven training solutions. Cloud-based simulation platforms and remote access training tools are enabling scalable, cost-effective, and flexible maritime education and certification.

The maritime simulators market is more than just a growth story; it’s a testament to the industry’s commitment to safety, innovation, and environmental stewardship. As demand for advanced training solutions accelerates, the market is poised for selective consolidation, increased collaboration, and deeper technology integration. The future of maritime training is here, and it’s more immersive, data-driven, and connected than ever before.